As part of the funding agreement between the Dictionary of Canadian Biography and the Canadian Museum of History, we invite readers to take part in a short survey.

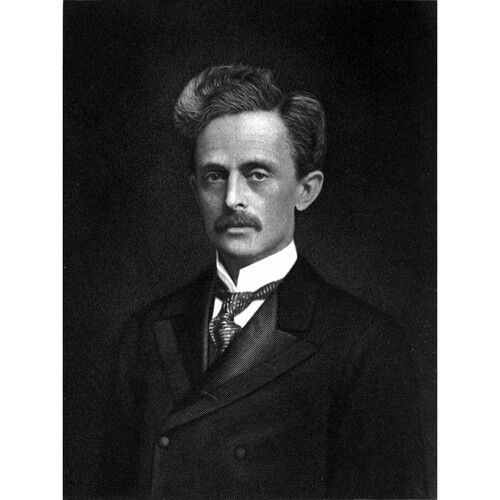

Source: Courtesy of Wikimedia Commons

PEARSON, FREDERICK STARK, electrical engineer and business promoter; b. 3 July 1861 in Lowell, Mass., son of Ambrose Pearson and Hannah Amelia Edgerly; m. there 5 Jan. 1887 Mabel Ward, and they had a daughter and two sons; d. 7 May 1915 at sea off the Irish coast.

Fred S. Pearson had a peripatetic youth since his father, a civil engineer with the Boston and Lowell Railroad, moved with New England’s rail frontier. Despite a fragile constitution, he displayed both a voracious appetite for knowledge, in particular philosophy, mathematics, and chemistry, and an aptitude for scientific tinkering. His father’s death in 1876 threw the weight of responsibility on his mother; by 1877 the family’s straits obliged him to take employment as a stationmaster on the Boston and Lowell at Medford. In 1879 a loan from an uncle allowed him to enrol there in Tufts College, where he excelled in mathematics and chemistry. After a year at the Massachusetts Institute of Technology, he returned to Tufts in 1881, and his reputation as a polymath grew. Professor Benjamin Graves Brown in mathematics arranged a teaching assistantship for him and Amos Emerson Dolbear in physics and astronomy drew out his fascination with applied electricity. Even at this time Pearson was displaying a talent, not as an inventor of electrical theories or devices, but as a bold applier of the ideas of others.

In 1883 Pearson obtained a bachelor of mechanical arts from Tufts and was awarded the Walker instructorship in mathematics. He nevertheless gravitated to mining and electrical engineering, largely under the influence of William Leslie Hooper, head of the college’s new department of electrical engineering. In the summer of 1884, for instance, he worked as a consultant at a gold-mine in Virginia. That same year he completed his master of mechanical arts at Tufts. Although he left academe forever in 1886, when he was sent to Texas by the American government to survey for minerals, Pearson, for his later enterprises, would draw from Tufts and nearby Harvard and MIT the best electrical engineering talent that America could provide. Typical of this number was B. G. Brown’s son Robert Calthrop, whom Pearson had tutored in mathematics. For its part, Tufts would later honour his achievements with a dsc in 1900 and an lld in 1905.

In 1886 Pearson travelled to Europe at the request of a Boston engineering firm to investigate the sewage system of Paris. While visiting Dresden (Germany) he encountered Mabel Ward, his childhood sweetheart and daughter of one of his father’s contracting partners. Fluent in German and French, she shared Fred’s love of music. Following their marriage in January 1887, Pearson completed his transition to a practising engineer. That summer he visited Brazil at the request of a Brazilian college friend who wanted his opinion on a mine in São Paulo state. The trip exposed Pearson to Brazil’s leading cities, Rio de Janeiro and São Paulo, and impressed him with the country’s economic potential. The Pearsons subsequently set up residence in Somerville, Mass., where Fred, with assistance from W. L. Hooper of Tufts, organized the Somerville Electric Light Company and the Woburn Electric Light Company. In addition, a subsidiary was formed to build electrical generators and boilers.

Pearson’s success as manager and treasurer of the Somerville and Woburn companies drew the attention of Henry Melville Whitney*, a steamship and real estate magnate who had consolidated six Boston-area horse railways into the West End Street Railway in 1887. To electrify the system and devise a reliable method of delivering power to the cars in Boston’s often inclement climate, Whitney turned to Pearson, who became the company’s chief engineer in 1889 at an annual salary of $2,500. He designed new, high-torque motors for the cars and oversaw the construction of a power station to house dynamos capable of producing an unprecedented 500 horsepower. Such advances reflected Pearson’s liaison with the pioneering manufacturers of electrical equipment in the United States, principally Thomson-Houston of Lynn, Mass., and Westinghouse Electric of Pittsburgh. By 1892 Pearson’s salary had risen to $12,000 and he had drawn many of his old academic friends, among them R. C. Brown, into his service in Boston. In these years two persistent traits of Pearson’s career became evident. He managed his companies with headlong optimism, trusting that technology and capital could always be acquired and stretched to meet any demand. At the same time his entrepreneurial brinkmanship exacted a harsh toll on his constitution; of nervous disposition, he was easily fatigued.

Pearson first became involved in Canada in 1889 through his Boston firm, Grant, Pearson and Company, which had been hired to build a gas plant in Halifax for Benjamin Franklin Pearson. (The account that the two Pearsons, who were unrelated, met through a mix-up of mail while Fred was on a yachting holiday to Halifax is likely apocryphal.) The plant was meant to convert coal into gas, and since both Fred Pearson and H. M. Whitney were looking for cheap fuel for their electrical operations in the Boston area, they joined B. F. Pearson and J. A. Grant in efforts to secure coalfields in Cape Breton. The incorporation of the Dominion Coal Company Limited in 1893, with F. S. Pearson as engineer-in-chief, Whitney as president, and B. F. Pearson as secretary, involved the group in the large-scale flotation of securities. Such high-risk finance also occurred in other ventures undertaken by the Pearsons and Whitney: the electrification of tramways in Halifax and the formation of the Dominion Iron and Steel Company Limited. In these related projects Pearson, for the first time, invested in enterprises in which he had some managerial involvement; in so doing he became affiliated with some of B. F. Pearson’s central Canadian financial associates, notably railway contractor turned utility promoter James Ross of Montreal.

In the United States Pearson’s strength remained electrical engineering. His success in Boston brought him an offer in 1894 to become chief engineer of the Metropolitan Street Railway in New York, created the previous year by Whitney’s brother, William Collins. Like its Boston counterpart, it faced problems in the generation and distribution of power; as well, it had to deal with demands that overhead wires not blight the streetscapes. Drawing on the recent theories of William Stanley, the American inventor who had identified the virtues of polyphase alternating current for efficient long-distance transmission, Pearson worked closely with Westinghouse Electric to develop huge generators and he devised an ingenious underground conduit for carrying power to the cars. The Metropolitan strained his nerves, however. Though his salary had risen to $75,000, he resigned in January 1898 and left for France, Switzerland, and Italy. Mabel Pearson hoped that the trip would mark the beginning of a life of leisure. In fact, it marked the most crucial watershed in Fred Pearson’s career: the transition from salaried manager to “techno-entrepreneur,” purveyor of North American electrical technology to Cuba, Brazil, Mexico, and Spain, backed by a maturing Canadian financial industry and later by European capital.

Home from Europe by mid 1898, Pearson indulged a childhood fancy and bought an ocean yacht, which he sailed to the Caribbean. He arrived in Cuba just as the Spanish-American War was subsiding, and became peripherally involved in schemes to set up public utilities. In particular, he lent his advice to flamboyant American promoter Percival Farquhar and the Hanson brothers of Montreal – Charles Augustine, Edwin*, and William – who were attempting to secure a streetcar concession for Havana. Farquhar’s success reflected his ability to attract other Canadian allies, among them Sir William Cornelius Van Horne of Montreal. He thus set a pattern for the wave of Canadian-American utility imperialism that would sweep through the Caribbean and Latin America. In many of these ventures Pearson was to be the technological wizard who lent his reputation, his contacts with American electrical-equipment makers, and his staff of electrical apostles.

Brazil first opened the door for Pearson. In 1899, while there to inspect a mine, he investigated a hydropower concession outside the embryonic industrial city of São Paulo. Drawn to his attention a year earlier in Montreal by railway contractor Francisco Antônio Gualco, a friend of James Ross, the concession held promise for anyone who could supply an integrated system of generation, transmission, and distribution. Egged on by sympathetic municipal politicians, Pearson and his engineers, led by R. C. Brown and the bold young hydraulics expert Hugh L. Cooper, mapped out such a system and secured a long-term concession. Pearson’s efforts to find financial support in New York failed, but on the recommendation of B. F. Pearson he approached, and secured the backing of, railway and utility magnate William Mackenzie*, capitalist George Albertus Cox, and others in Toronto’s financial community. To take advantage of lax Canadian laws relating to securities and corporations, and to reassure investors, an Ontario charter was obtained in 1899 for the São Paulo Tramway, Light and Power Company Limited. This process reflected the hope of Pearson and his backers that British and European financiers, long used to investing in Canadian railways, could be converted to the funding of seemingly Canadian-run enterprises in countries that investors had traditionally avoided. In 1904 a second firm, the Rio de Janeiro Tramway, Light and Power Company Limited, was established in Brazil’s largest city and incorporated in Canada. In both enterprises a coterie of Montreal and Toronto financiers, including James Hamet Dunn*, placed the shares with European investors, often using questionable promotional practices, notably the watering of stock, while such Canadian business moguls as William Mackenzie allowed their names to decorate the boards of directors. Pearson was always given prominence as the consulting engineer and his New York office and company, Pearson Engineering Corporation, served as the point of coordination for staffing and equipment needs.

In 1901 mining ventures in Texas had carried Pearson into the Mexican border state of Chihuahua and on to Mexico City, where the following year he joined a group of Halifax and Montreal promoters in securing a power concession on the Necaxa River, outside Mexico City. The Mexican Light and Power Company Limited was chartered under Canadian law later in 1902 and financed in part by the Bank of Montreal; Mexico Tramways was added in 1906. The years 1903 to 1907 were probably the busiest of Pearson’s career. Dams and powerplants were built at Necaxa and Lajes outside Rio. In Canada he lent his name and consulting expertise to a generating station in the Niagara River gorge for Mackenzie’s Toronto and Niagara Power Company and in Manitoba to the Lac du Bonnet hydro-power station and the gas-fired station for Mackenzie’s electric railway in Winnipeg.

Pearson travelled constantly from project to project, applying his prodigious memory and a torrent of telegrams to the exigencies of construction on two continents. Investors began to talk of “the Pearson group” of companies. Though all of them were meticulously separate legal entities, they shared a common provenance in Toronto (devised by Canada’s premier corporate lawyer, Zebulon Aiton Lash of Blake, Lash, and Cassels), a common promotional strategy, and a uniformly sterling reputation on the financial markets. Largely as a result of his hectic life, Pearson’s health remained precarious, and he developed an interest in esoteric therapies and diets. In 1902 he had sought respite by buying a country estate in Great Barrington, Mass., but this too became an obsession into which he poured both ingenuity – a miniature powerplant – and money.

In 1907 Pearson’s promotional formula and the financial integrity of his group first showed signs of weakness. His Mexican and Latin American enterprises depended on a steady flow of foreign capital and technology into regions of political stability and rapid economic growth. The constriction of capital or technology, or any political unrest or xenophobia, could subvert the whole process. By 1907 Pearson had begun to exhaust the capacity of the relatively small Canadian capital market. A financial panic in October 1907 frightened American and European investors and almost immediately new capital to the Pearson group was cut off. The Rio company, caught in the throes of expansion, suffered most. Almost as soon as construction was curtailed, local politicians began pushing for changes to the “foreign” concession. The panic passed quickly but it left a legacy of nervousness, especially since (unknown to most small investors) Pearson’s financial allies (Dunn and others) had used the great engineer’s reputation to misrepresent the actual worth of the stock of the various companies. Though Pearson was not the author of such practices, he was clearly aware of them – and of their implications. His biographer, the otherwise sympathetic William Stearns Morse of Dartmouth College, felt obliged to describe Pearson as “a juggler on a cosmic scale” and to acknowledge his “strong gambling streak.” After 1907 the financial needs of his enterprises obliged Pearson to spend more and more time in London, England, the hub of international capital, where some Canadian promoters, such as J. H. Dunn, now operated. About 1911 he leased an estate in Surrey and he was soon drawn into the social life of the City.

Within four years of the 1907 crisis Pearson faced disappointment in the United States and subversion in Mexico. With Percival Farquhar he formed a syndicate which in January 1910 began buying up stock in the Rock Island and other American railways. Its goal was to gain control of 20,000 miles of line and create a mid-continental system. Backed by many of the same English and Canadian financiers who had floated Pearson’s utility enterprises, the Rock Island syndicate was rumoured to have spent $30 million by July, when, having failed to capture control, it had to be rescued by a larger syndicate, headed by Kuhn, Loeb and Company. The nervous strain of this gamble reportedly turned Pearson’s hair white. In Mexico, after building up Mexican Light and Power and Mexico Tramways, he had acquired timber rights in Chihuahua in 1909, set up lumber and paper companies, and had a railway constructed over a tortuous route to the Pacific to move the lumber and paper. But as these enterprises were being built, the political foundation of Pearson’s involvement – the regime of Porfirio Díaz – was beginning to crumble. His fall in 1911 launched a long civil war, in which, despite American intervention in 1914, Pearson’s enterprises faced civil unrest, outright attacks, xenophobia, and operational chaos.

The indomitable Pearson still did not shy away from international opportunity. He found his last frontier in Spain, where in 1911 he had applied his long-standing formula for the development of public utilities. The Barcelona Traction, Light and Power Company Limited was chartered in Canada to acquire control of two local power companies, and Spanish royal proclamations gave it the rights to generate and distribute power. A subsidiary set about building dams to create reservoirs for the powerplants and to irrigate adjacent lands. The Talarn dam on a tributary of the Ebro River, begun in 1913, was a gigantic project that required ten million cubic feet of concrete. However, together with the Lerida and Seros powerhouses, it placed a huge financial strain on the project’s European backers. Pearson’s breakneck approach to construction and his frequent obliviousness to costs frayed relations with Alfred Loewenstein, the Belgian financier who had made the market for the Barcelona company in London. Even before this strain had developed there had been one last financial sleight of hand involving Pearson. In 1912 his group’s Brazilian companies were brought under the control of Brazilian Traction, Light and Power, another Toronto-based company whose existence was publicly justified in terms of organizational efficiency but which, in reality, was chiefly an exercise in stock watering. Its board, chaired by William Mackenzie, with Pearson as president, was carefully selected to inspire confidence.

By cutting off European capital, the outbreak of war in 1914 undercut the Pearson group with devastating effect. The Mexican companies were already suffering and Brazil’s deteriorating exchange situation soon greatly diminished Brazilian Traction’s ability to remit profits. At the end of 1914 European investors, exasperated by the overruns of the Barcelona project, dislodged Pearson from its presidency and turned control over to a bondholders’ committee.

As a result of these troubles Pearson was reduced to shuttling back and forth across the Atlantic to appease creditors and shore up relations with investors, all the while overseeing the technical management of his remaining enterprises. On one of these journeys, in 1915, Fred and Mabel Pearson met their deaths when the Lusitania was torpedoed. Survivors reported that they had last seen them holding hands on the slanting deck of the liner. The Pearsons were buried in New York’s Woodlawn Cemetery. Their son Ward Edgerly took control of Pearson Engineering, but court proceedings soon revealed that his father had died insolvent. (In 1925 the family would manage to collect $106,000 in war reparations.) F. S. Pearson’s death panicked investors and broke the group’s integrity forever. The Mexican and Barcelona firms struggled on against unending political, legal, and investment difficulties; the Mexican companies were finally reorganized in the 1920s but the Barcelona company succumbed during the Spanish Civil War. Only Brazilian Traction survived unscathed; it would remain the largest overseas Canadian investment until the 1950s.

Pearson’s legacy lay in drafting an early blueprint for the transfer of capital and technology from countries on the cutting edge of urban and industrial advance to those lagging in the process. This plan was blemished by financial improprieties and poor management, but Pearson’s dams, power stations (some of which still function), and streetcars played an undeniable role in allowing such cities as São Paulo and Mexico City to assert themselves as the premier social, political, and economic centres of their respective countries. In Canada Pearson’s technical contributions helped place power generation in Nova Scotia, Ontario, and Manitoba at the forefront of electrical engineering. Financially, where railways had moved Canadian investment to international levels in the 19th century, utility ventures in the Caribbean and Latin America took on the same role early in the 20th.

[There is no consolidated collection of F. S. Pearson papers. The fact that his career was so peripatetic and ended so dramatically and at such a low point in his entrepreneurial fortunes militated against the preservation of a coherent body of material. His career can be reassembled only by consulting the records of his various business connections. At the NA, the Brascan (Brazilian Traction, Light and Power) papers (MG 28, III 112) and the Sir James H. Dunn papers (MG 30, A51) are rich in correspondence pertaining to Pearson’s engineering and financial activities. The Toronto legal firm of Fasken Campbell Godfrey has custody of the records of Mexico Tramways; those of Mexican Light and Power are in the possession of another Toronto law firm, Blake, Cassels, and Graydon. The archives of Rio Light (Rio de Janeiro) and São Paulo Light (São Paulo), the government-owned remnants of the Brazilian Traction empire, contain records of Pearson’s technical activities in these cities. They also include a valuable collection of engineering photographs of the dams, powerplants and streetcar operations under his direction in Brazil; some contain shots of Pearson himself. Brascan Limited in Toronto has in its boardroom a bas-relief portrait of Pearson set against a backdrop of the waterfall on the Necaxa River.

Much can be gleaned from Pearson’s career from books written about individual companies in the Pearson group, about his financial associates, and about the whole phenomenon of Canadian utilities imperialism. These studies include Christopher Armstrong and H. V. Nelles, Southern exposure: Canadian promoters in Latin America and the Caribbean, 1896–1930 (Toronto, 1988); Duncan McDowall, The Light: Brazilian Traction, Light and Power Company Limited, 1899–1945 (Toronto, 1988) and Steel at the Sault: Francis H. Clergue, Sir James Dunn, and the Algoma Steel Corporation, 1901–1956 (Toronto, 1984); G. P. Marchildon, Profits and politics: Beaverbrook and the Gilded Age of Canadian finance (Toronto, 1996); and C. A. Gauld, The last titan: Percival Farquhar, American entrepreneur in Latin America (Stanford, Calif., 1964).

Biographical information concerning Pearson appears in the National cyclopædia of American biography . . . (63v., New York, [etc.], 1892–1984), 18: 123–24; in a typescript entitled “The Yankee spirit,” prepared by William Stearns Morse sometime in the 1940s (a copy is in the contributor’s possession and a copy of the section on Pearson is available at Tufts Univ. Library, Medford, Mass.); and in an uncredited 26-page essay, also at Tufts, entitled “Fred Stark Pearson” (typescript, n.d.). Details of Pearson’s academic career are found in R. E. Miller, Light on the hill: a history of Tufts College (Boston, 1966). Pearson himself wrote little; a sample publication is “The latest developments in electric conduit railways,” Cassier’s Magazine (New York and London), 16 (May–October 1899): 257–82. d.mcd.]

Cite This Article

Duncan McDowall, “PEARSON, FREDERICK STARK,” in Dictionary of Canadian Biography, vol. 14, University of Toronto/Université Laval, 2003–, accessed March 29, 2025, https://www.biographi.ca/en/bio/pearson_frederick_stark_14E.html.

The citation above shows the format for footnotes and endnotes according to the Chicago manual of style (16th edition). Information to be used in other citation formats:

| Permalink: | https://www.biographi.ca/en/bio/pearson_frederick_stark_14E.html |

| Author of Article: | Duncan McDowall |

| Title of Article: | PEARSON, FREDERICK STARK |

| Publication Name: | Dictionary of Canadian Biography, vol. 14 |

| Publisher: | University of Toronto/Université Laval |

| Year of revision: | 1998 |

| Access Date: | March 29, 2025 |