Source: Link

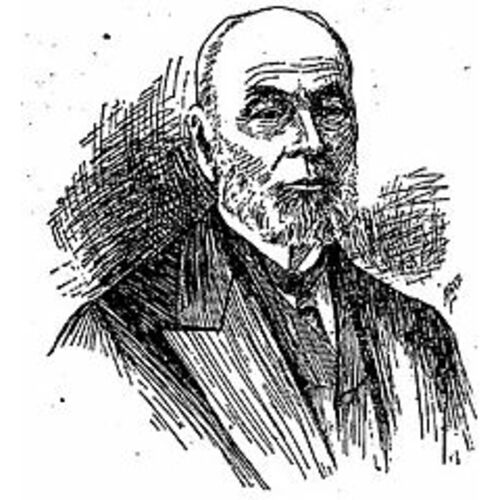

AUSTIN, JAMES, printer and businessman; b. 6 March 1813 in Tandragee (Northern Ireland), son of John Marks Austin; m. 28 Nov. 1844 Susan Bright in Toronto, and they had three sons and two daughters; d. there 27 Feb. 1897.

James Austin’s father, having heard favourable reports of Upper Canada, decided to emigrate with his wife and five children. Reaching York (Toronto) in October 1829, they spent two months there while seeking a farm. Before the Austins left to settle in Trafalgar Township, 16-year-old James was apprenticed to William Lyon Mackenzie* to learn the printing trade. Austin spent four and a half years in Mackenzie’s shop and later struck out on his own as a printer. After the rebellion of 1837–38 he considered it prudent, because of his association with Mackenzie, to leave the province, so he retreated to the United States for some years.

By 1843 Austin judged it safe to return. He possessed sufficient capital to set up as a wholesale and retail grocer in partnership with another Irishman, Patrick Foy. What made them an unusual combination was that Foy was a Roman Catholic and a tory, Austin a Methodist and a reformer. Their successful collaboration was, in Foy’s words, “an example of what Orange and Green might do when working in harmony instead of dissipating their energies against each other.” Perhaps the partnership was made easier because Austin was not, it appears, particularly devout in his religious observance, a fact reflected in his membership in a firm styled as liquor merchants in the 1846–47 city directory.

Foy and Austin prospered sufficiently that in 1849 they were able to lend $20,000 to another ambitious Irish Catholic, Frank Smith*, to establish himself in the grocery trade in London. That same year fire destroyed their Toronto premises, but they soon reopened and even leased space in the prestigious new St Lawrence Hall, which they in turn rented out. Their grocery business continued to flourish through the 1850s, but by 1859 Canada was in the grip of a severe depression. Austin concluded that it had become so difficult to establish the credit-worthiness of customers that “in other channels more money was to be made, and that on a much more secure basis.” He therefore liquidated the partnership with Foy, who carried on in the business, and invested his proceeds in other, less risky enterprises, including the Consumers’ Gas Company of Toronto.

Austin’s skills as a financier and rentier quickly made him a leading figure in Toronto’s business community. In 1866 he purchased Spadina, the house built by William Warren Baldwin* on the escarpment overlooking the rapidly growing city and later occupied by his son Robert*. Austin’s bid of £3,550 topped those of John Ross*, former president of the Grand Trunk Railway, and John Macdonald*, the dry-goods magnate. The Baldwin home was demolished and the Austin family soon built a grander house (also named Spadina) on the site, tangible evidence of James’s arrival as a prominent member of the local élite. Spadina, in which the contents and decoration of Austin’s time were largely preserved by his descendants, is now a museum.

By the 1860s Toronto businessmen had become increasingly restive with Montreal’s commercial and financial dominance over the Canadian economy. In 1867 William McMaster* decided to found a Toronto-based bank as a protest against the restrictive credit policies of the Bank of Montreal; he invited Austin to become a director. The Canadian Bank of Commerce was a success from the start, and by 1869 McMaster was eager to expand rapidly. The more cautious Austin was afraid of moving too quickly and of the bank’s becoming over-extended, so he did not stand for re-election to the board in 1870.

Within a few months, however, Austin had become involved in plans to set up another bank hatched by a group of Torontonians that included John Ross, John Crawford, Walter Sutherland Lee*, and Senator James Cox Aikins*. They had joined with three prominent businessmen from Ontario County to the east of the city, Joseph Gould*, James Holden, and Aaron Ross. The original plan had been for their new Dominion Bank, organized in 1869 but not opened, to take over the troubled Royal Canadian Bank, of which Crawford was president, but it had proved impossible to raise the necessary funds. Eventually Holden approached Austin, and he and a group of friends including Frank Smith, Peleg Howland, Samuel Nordheimer, and Joseph Hooper Mead agreed in late 1870 to invest, provided the takeover of the Royal Canadian was dropped. With their support stock subscriptions worth more than $500,000 were quickly pledged.

In January 1871 Austin became president of the Dominion Bank, which opened on 1 February. He soon suggested that, in addition to its main office on King Street East, there should be a branch nearer the residential quarter, mainly for the convenience of savings depositors. This was located on Queen Street West. Other chartered banks soon followed this innovative practice of operating multiple branches in larger urban centres. Before the recession of 1874 struck, the Dominion Bank had three good years which set it firmly on its feet; the paid-up capital had increased to nearly $1,000,000. Although profits declined in the mid 1870s, growth resumed once good times returned in the 1880s. By 1896 its capital had increased to $1,500,000. Austin himself had originally acquired $32,000 worth of shares and by 1875 held stock with a par value of nearly $180,000, making him by far the largest shareholder. Until his death in 1897 Austin remained intimately involved in all aspects of the bank’s management. He faithfully attended the weekly meetings of the board at which every application for a sizeable loan was carefully discussed. As in the grocery business, the key to success lay in correctly assessing the credit-worthiness of each borrower. In the absence of a large corporate bureaucracy, Austin and his cashier, Robert Henry Bethune, ran the day-to-day affairs of the bank.

In 1871 Austin also joined with William Holmes Howland to found the Queen City Fire Insurance Company. The incorporators argued that forming a local company to write insurance only on property in York County would be beneficial, since it would prevent premiums flowing to foreign insurers (the geographical restriction was eliminated in 1887). The investors raised $10,000 and the company commenced business in the summer of 1871. Besides Austin and Howland, who served as president, the directors were Robert G. Barrett, Thomas McCrossan, John MacNab, and William Paterson. Acceptance of a directorship meant intimate involvement in the most minute details of the company’s activities. The board met weekly to consider all applications for insurance and reinsurance as well as the investment of funds on hand. When the company’s secretary-manager, Hugh Scott, left the city temporarily, Austin and McCrossan agreed to visit the office daily and assume his functions. Austin became vice-president in 1875, which further increased his responsibilities. Occasionally he inspected property on which the company was considering lending money. In 1884, the meetings of the directors became fortnightly, with Austin still in faithful attendance. When Howland died in 1893 Austin succeeded him as president although he was 80 years of age. Perhaps there is a hint that by 1897 his managerial style reflected an age already passing: after his death the board immediately decided to hold its meetings on a monthly basis.

The insurance company, of course, fitted well with Austin’s other financial interests, particularly the Dominion Bank. Company funds were deposited in the bank until permanently invested, and its vault became the repository for all securities. In 1873 the bank’s accountant was made company auditor, and when it was proposed two years later that a branch office of the insurance company be opened on the premises of the People’s Loan and Deposit Office, the suggestion was rejected by the company’s board. As a skilled investor, Austin was relied upon by the board to find profitable investments in building societies, mortgages, stocks, and bonds. On one occasion in 1871 he offered to sell to the company a mortgage that he himself held. The question of whether it was ethical to make such a purchase from a director was raised, but the board decided to go ahead, “viewing the mortgage as a transferable financial security, and as being very desirable and safer, such being very difficult to procure at present.”

Austin’s 40 shares of stock in the company (out of a total of 2,000) proved a desirable investment. After a year in business a 10 per cent dividend was declared on the paid-up capital of $10,000, a return which continued until 1880, when the dividend was doubled. In 1882 the board decided to increase the capital stock to $50,000; the funds required were supplied to the shareholders by paying a special 400 per cent dividend ($40,000) out of the accumulated surplus. Thereafter the company paid a regular 5 per cent annual dividend (25 per cent on the original $10,000 investment). Business remained so good that despite the depression of the early 1890s, bonus dividends were paid on three occasions. In 1887 the policyholders were even granted a 5 per cent dividend, which must have been an unusual practice for a joint-stock insurance company.

Banking and insurance did not exhaust the range of Austin’s financial interests. In 1875 he joined another prominent Toronto financier, Edmund Boyd Osler*, on the Canadian board of management of the Aberdeen-based North of Scotland Mortgage Company. As chairman, Austin oversaw the investment of Scottish funds in Canadian land. His associate in the Dominion Bank, James Holden, also persuaded him to take an interest in the Port Whitby and Port Perry Railway. In the 1860s Holden had hoped to channel the trade of the interior through Whitby and ultimately to extend the line to Georgian Bay and beyond, but the rails reached only as far as Port Perry on Lake Scugog, and the company was teetering on the edge of bankruptcy. Austin examined the proposition and consulted a couple of Torontonians prominent in the grocery trade, James Michie and Alexander Thomson Fulton. In 1872 they decided to put money into the road, Austin becoming president and Michie vice-president, leaving Holden in charge of day-to-day operations. The syndicate soon got the company’s affairs in order, extended the line to Lindsay in 1876, and fulfilled Austin’s prediction that, “if properly managed, it can’t fail to be profitable.”

In fact, virtually all of Austin’s business activities seem to have been successful. In 1889, for instance, he subdivided part of Spadina’s extensive grounds. On the sale of these building-lots he probably realized about $200,000, a healthy profit on his original investment of $14,000 for the entire property. To his son Albert William* he gave funds to invest in mortgages when the young man went to Winnipeg in 1880 to make his fortune. In 1882, with the backing of his father and E. B. Osler, Albert incorporated the Winnipeg Street Railway Company, which he ultimately sold to rival interests for $175,000 in 1894. In time he would succeed his father as president of both the Dominion Bank and the Consumers’ Gas Company.

James Austin was not merely a financier and rentier, for he demonstrated early that he possessed the strategic judgement of a good corporate manager. The Consumers’ Gas Company had been established for about a decade to provide lighting in Toronto, when in 1859 Austin invested heavily in it and was promptly elected to its board of directors. Although the utility remained profitable, demand for gas fell sharply after the depression of 1859, and in these trying times Austin’s fellow directors chose him in 1867 as vice-president. In 1874 complaints were made by some of the office staff that the president, Edward Henderson Rutherford, was padding his expenses; these accusations were investigated by the board and found, to its chagrin, to be correct. The directors therefore turned to Austin to take over as president, which he remained for the rest of his life.

Austin’s major challenge as a manager was coping with technological change. During the 1870s a process of producing gas from coal by injecting water vapour and petroleum into the retorts was developed in the United States. This “carburetted water gas” was not only cheaper to produce but its calorific value could be accurately regulated, and Consumers’ Gas had adopted the new technique by 1880. After some initial problems with quality, the innovation was a great success, permitting rates to be cut from $1.75 per thousand cubic feet in 1879 to 90¢ by 1896. At the same time profits stayed high and large reserves piled up in the treasury.

Austin also had to cope with growing competition in the lighting market. In 1879 Consumers’ Gas sought to protect itself by procuring an amendment to its provincial charter to permit it to enter the electrical business. In 1889 the company decided to purchase the rights to the Westinghouse system of lighting, but city council would not allow it to string electric wires along public thoroughfares. The aldermen were convinced that accumulated profits from gas sales would be used to finance the electrical business. Not only was Consumers’ Gas prevented from supplying electricity, but in 1891 the city replaced a large number of gas street-lights with brighter electric lamps.

Despite this reverse, the gas company continued to prosper under Austin’s management, introducing volume discounts for large customers and encouraging the use of gas for cooking and heating. In 1887 it secured an amendment to its charter which permitted it to build up a large reserve fund to meet the cost of repairs and additions. Once that fund reached a certain size there were to be reductions in rates, but Austin shrewdly maintained the fund at a level just below the point that would trigger rate cuts and financed extensive capital works out of retained earnings. Despite fierce criticism from municipal authorities, the company never wavered and it was in excellent shape at Austin’s death.

In the 1890s, when Austin was over eighty and suffering from increasing deafness, he became a reclusive figure. He died in February 1897 after an illness of several weeks and, though a Methodist, he was buried in the family vault at St James’ Cemetery (Anglican). His career reveals much about the qualities required to succeed in business in 19th-century Canada. He once wrote to his son Albert, “The successful man is always considered a smart man and be careful you hold to that reputation.” Those who dealt with Austin recognized the shrewdness that took him from printer’s apprentice to bank president. He also seems to have possessed great entrepreneurial skill as well as the ability to adapt to changing times and to new types of business organization. In Austin’s case good management was aided by good luck. The Dominion Bank and the Queen City Fire Insurance Company were soundly enough established that when recession occurred in the mid 1870s they were able to survive and prosper without serious difficulties. But James Austin seems to have learned very early the lesson that accurately assessing the credit-worthiness of those with whom one dealt was all-important.

One other point bears mention: the small size of the local business élite in a regional centre such as Toronto. Austin might have left the board of the Canadian Bank of Commerce owing to a disagreement with William McMaster, but he and McMaster would still sit together for years on the board of Consumers’ Gas. Austin and William Howland founded the Queen City Fire Insurance Company together, but in 1886, when Howland became mayor, they found themselves facing each other across the bargaining table on the issue of gas rates. That did not destroy their business relationship. Shrewdness, adaptability, luck, and amiability earned James Austin a sizeable fortune in the course of his long business career.

[A few letters from James Austin to his son Albert William, discussing the latter’s move to Winnipeg in 1880, remain in the possession of Mrs Joan Thompson of Toronto, the widow of James Austin’s great-grandson, Austin Seton Thompson. Information on Consumers’ Gas comes from the author’s unpublished paper “In defence of private enterprise: gas supply in Toronto, 1840–1910” (Toronto, 1982). c.a.]

Consumers’ Gas Company (Toronto), Annual reports; Corr.; Minute-books (mfm. of reports and minute-books at York Univ. Arch., Toronto). Royal Insurance Company of Canada (Toronto), Queen City Fire Insurance Company, minute-book. Can., Parl., Sessional papers, 1872, no.13; 1875, no.22. Davin, Irishman in Canada, 272–73. Toronto directory, 1837–61. Dominion Bank, Fifty years of banking service, 1871–1921: the Dominion Bank, [comp. O. D. Skelton et al.] (Toronto, 1922). Joseph Schull, 100 years of banking in Canada: a history of the Toronto-Dominion Bank (Toronto, 1958). 75th birthday: 1848–1923, the Consumers’ Gas Company of Toronto, comp. E. J. Tucker (Toronto, 1923). A. S. Thompson, Spadina: a story of old Toronto (Toronto, 1975).

Cite This Article

Christopher Armstrong, “AUSTIN, JAMES,” in Dictionary of Canadian Biography, vol. 12, University of Toronto/Université Laval, 2003–, accessed December 26, 2025, https://www.biographi.ca/en/bio/austin_james_12E.html.

The citation above shows the format for footnotes and endnotes according to the Chicago manual of style (16th edition). Information to be used in other citation formats:

| Permalink: | https://www.biographi.ca/en/bio/austin_james_12E.html |

| Author of Article: | Christopher Armstrong |

| Title of Article: | AUSTIN, JAMES |

| Publication Name: | Dictionary of Canadian Biography, vol. 12 |

| Publisher: | University of Toronto/Université Laval |

| Year of publication: | 1990 |

| Year of revision: | 1990 |

| Access Date: | December 26, 2025 |